Dreams delayed

As part of our question set on what people are doing in response to rapidly rising bills, Brits offer up a range of behaviours … some don’t surprise while others make for very stark reading.

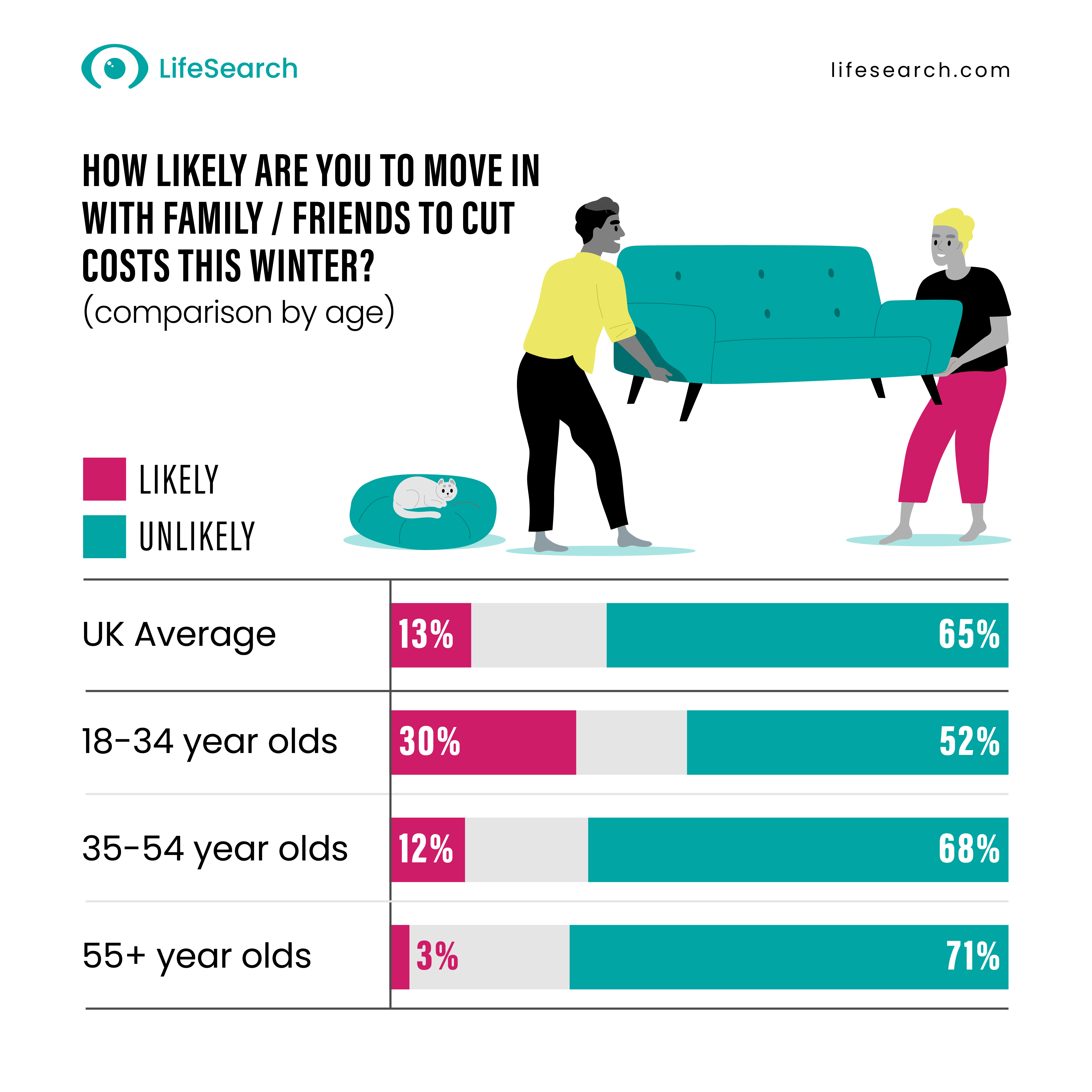

Let’s look at the answers by age group:

18-34s

In the 18-34 age bracket, 17% say they’ve already borrowed from friends and/ or family and 5% have borrowed from an ‘informal’ money lender while 2% have declared themselves bankrupt.Some 8% say they’ve downsized their home (rental and mortgaged) and 4% have, sadly, given a pet up for adoption.

35-54s

In the 35-54 age category the responses feel less dramatic at first glance, with 42% saying they’ve conducted spending reviews and 15% turning to short term borrowing.But a hefty portion (17%) say they now work more hours, and 6% say they’ve taken a second job to prop up their income.

55 and overs

In the 55+ category, 28% say they’ve had to dig into their savings in the last six months and over a third (36%) have undertaken a spending review.

And while the percentages and numbers of 55-and-overs taking somewhat drastic steps to curb spending isn’t as high as younger age categories, it’s still revealing that one in 20 (5%) say they’re working more hours, one in 50 (2%) have taken on an additional job, and another one in 50 (2%) say they’ve elected to downsize their home.

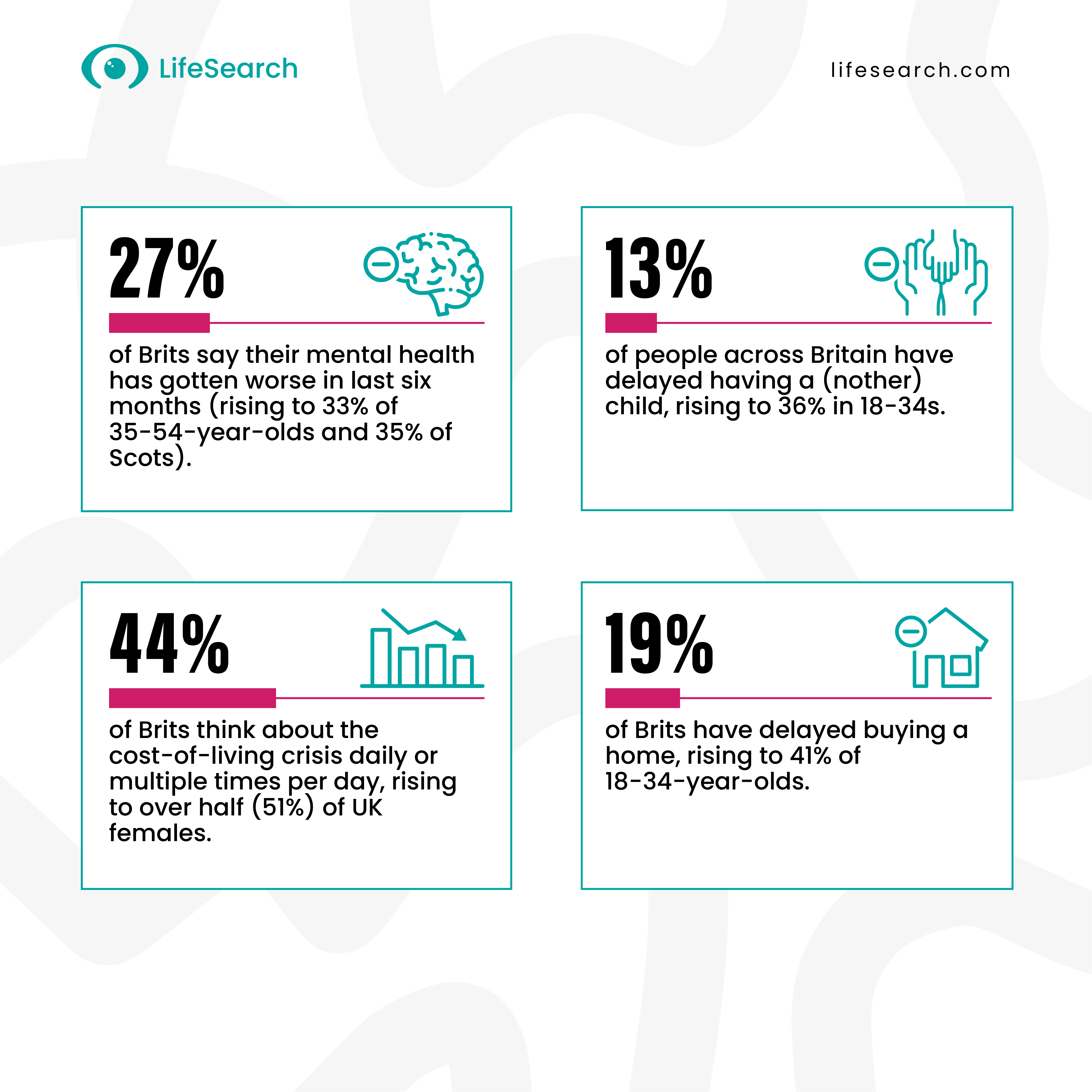

Dreams delayed

Here things get bleak. We now know that over a third (36%) of UK 18-34-year-olds say they have delayed starting a family or having another child as a direct result of the cost-of-living crisis. Almost the same percentage (31%) say they have delayed getting a pet.

More than that, three in ten (30%) 18-34-year-olds say they’ve kicked their hopes of starting a business into the long grass, at least for the moment, and 3% say they’ve already traded in their self-employment status for a salaried/ employed job.

High earners pushing pause

The assumption is probably that younger people (18-34) are pausing their dreams chiefly for financial reasons, and no doubt because now is such an uncertain time in general.But we see in the data that, once again, the impact - or shockwave – of the current crisis is being felt high up on the income ladder. In fact we can go even further and say that the bigger a person’s income, the more likely it is that they’re delaying some of those big life dreams.

Take having a (nother) child, for example. A relatively small 6% of those who earn under £20,000 p/a say they’re delaying this big life goal … but the percentages rise in parallel with income.

Over one in ten (11%) who earn £30,000-£40,000 have delayed having a child. So have one in four (26%) who earn between £60,000 and £70,000. In the £80,000 to £100,000 income bracket it’s over one in three (36%).

Getting a pet, starting a business - it’s a similar story across the board. More than one in three people who earn between £70,000 and £100,000 p/a say they’ve delayed buying a home, which is more than double the percentage of those who earn between £30,000 and £50,000.

We’re a bit broken-record at this point, but the data is so clear in how the current crisis is biting deep into what were once called the middle-classes. People who may, even six months ago, have assumed they had financial security to weather the storm are having to reset their expectations and push pause on some of those big life goals.

Further reading

To explore the ways in which different UK demographics, regions, households and families are coping with the vice-like squeeze on their incomes, you can read blogs stemming from the Health, Wealth & Happiness Hub, or you can read the report in full.A ‘Searcher since 2015, John is a Protection expert having worked in our customer facing teams and best practice teams, and now is immersed in Protection Content and Marketing.See all articles by John Rogers

Why Mortgage Protection Shouldn’t Be Overlooked

Find out about the latest HomeOwner Survey, conducted by HomeOwners Alliance in partnership with LifeSearch and others.

21 Sep 2025, by LifeSearch

4 min read

Debbie Kennedy Features on the IFA Talk Podcast

Listen to Debbie Kennedy discuss the growing protection gap among UK mortgage holders.

11 Sep 2025, by LifeSearch

6 min read

Females hit harder on mortgage payments

Female mortgage holders could be working harder to stay afloat as income shocks expose widening protection gap.

10 Jul 2025, by LifeSearch

6 min read