We’ll get your mortgage protection insurance quotes from the UK’s leading insurers.

What is mortgage protection insurance?

Buying a home is a big step, and a big financial responsibility. You may have saved up for years to get on the housing ladder and now you have, you’ll want to protect that all-important mortgage.

Mortgage protection insurance (sometimes known as mortgage life insurance) is a type of life insurance policy designed to handle this debt when you pass away. It gives you peace of mind knowing that your loved ones won’t be left struggling with repayments or risk losing the home.

Types of mortgage protection insurance

There are two main types of mortgage protection insurance, level term and decreasing term. Both are types of term life insurance, meaning they provide cover for a set number of years, known as the policy term. If you pass away during this time, the policy pays out a lump sum. If you pass away after the term ends, no payout is made.

The key difference between level and decreasing term cover is how the payout amount works over time.

Decreasing term mortgage life insurance

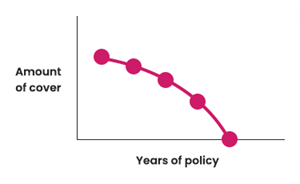

This is the most common type of cover, especially for repayment mortgages. Decreasing term mortgage protection policies are designed to pay off whatever is left on your mortgage at the time of death. As such, the amount of cover reduces over time, in line with your mortgage repayments against your mortgage balance.

For example, if you take out £250,000 of cover over 25 years and pass away with £150,000 left to pay on your mortgage, the payout would be £150,000.

Advantages of decreasing term cover

- Usually cheaper than level term policies

- Payments are fixed and will not change during the duration of the policy

- Peace of mind your mortgage is covered

- Your cover amount reduces in line with your mortgage debt, so you’re only paying for the protection you need

Disadvantages of decreasing term cover

- Only covers the mortgage, leaving no extra financial support for loved ones

- You may be left with a shortfall if there are changes to your mortgage such as interest rate increases

Level term mortgage life insurance

With level term cover, the payout amount stays the same throughout the policy, even as your mortgage balance goes down. This type of cover is typically taken out by those who have an interest-only mortgage.

For example, if you have £250,000 left to pay on your mortgage and you take out £250,000 of level term cover for 25 years, your beneficiaries will receive £250,000 when you pass away, regardless of the amount you have left to pay on your mortgage.

Advantages of level term cover

- Payout amount is fixed and predictable

- Your premiums are fixed throughout the duration of your policy

- Provides extra financial support for your loved ones, as the payout can be higher than your remaining mortgage

Disadvantages of level term cover

- Generally, more expensive than decreasing cover

- If you don’t index-link your policy, it could be worth less at point of claim

You can choose to link your level term mortgage life insurance to inflation. It’s called indexation or index-linking. This helps maintain the real value of your cover as, for example, £250,000 now won’t have the same buying power in 10- or 20-years’ time.

Inflation and the cost-of-living drive up consumer prices over time. If you spent £100 in 2010 and tried to repeat the exact same transaction in 2020, you’d have needed £22 more.

Index-linking means that your level term mortgage life insurance pay-out rises over time to match the same buying power you had when the policy began. Premiums do go up to match, so you’ll gradually pay more in premiums to, again, reflect the rising cost of living.

Do I need a mortgage life insurance policy?

While it’s not a legal requirement, mortgage protection can be a smart move, especially if your have a family or dependants. If you’re no longer here to make mortgage payments, this type of insurance can help your family keep their home by paying off the remaining mortgage and easing the financial pressure at a difficult time.

How much does it cost?

Prices vary depending on your personal circumstances, the size of your mortgage and the type of cover you need. Cover can start from as little as £5 per month*, but factors that affect the cost can include:

- Age

- Health and medical history

- Lifestyle choices (such as whether you’re a smoker and how much alcohol you drink)

- Mortgage amount and term

- Type of cover - level or decreasing

- In general, decreasing cover is cheaper than level cover because the insurer’s risk reduces as your mortgage balance decreases over time

*Mortgage Protection Insurance from £5 per month: 30 year old female client, non-smoker- decreasing £150,000 over a 25 year term - £5.02 pm. Quote obtained 16/01/2026.

Use our quick cover calculator to get started

What’s the ‘right amount’ of life cover?

It's different for everyone. To figure out the ‘right amount' of cover for you, you'll want to factor in your outstanding debt, your family commitments (now and in future) and what you can afford to spend each month in premiums.

Our calculator will help. And after you calculate the ‘right amount' of cover, give us a call (or leave your details we’ll call you) so LifeSearch can search the market for policies that match what you’re after.

How LifeSearch can support you

At LifeSearch, we help you find protection that fits your life and protects what matters most.

You can speak to one of our advisers for personalised guidance, which we always recommend. We listen to your needs, explain your options in plain English, and guide you to cover that’s right for you – without pressure or jargon.

Alternatively, you can get a quote and buy online without advice if you prefer. In which case you will be responsible for ensuring the policy meets your needs.

We work with the UK’s leading insurers to find the right policy for your needs. Since 1998, we’ve helped over a million people secure policies, giving real peace of mind when life takes an unexpected turn.

"Great experience getting the best quote for mortgage and life insurance. Owen was very helpful and advised us on the best combination of products to cover our needs.”

Frequently asked questions

No, you’re not legally required to have it. However, some mortgage lenders may require you to have mortgage protection as a condition of the loan.

If your mortgage and insurance terms match, your mortgage protection policy will usually end when the term finishes, provided you haven’t made a claim. At that point, your cover stops, but it’s a good time to review whether you might need other types of protection, such as income protection, critical illness insurance, life insurance or private medical insurance.

If you have a fixed term policy and pay off your mortgage early, unless you cancel it, your policy will continue until the end of the term, giving you peace of mind for the remainder of the policy.

Standard mortgage protection policies typically cover death only. Additional products like income protection or critical illness insurance can be added or purchased separately to cover your monthly mortgage repayments against illness or if you are unable to work.

If you have pre-existing medical conditions or are concerned about sick pay in the event of a serious injury or critical illness, our team at LifeSearch are here to advise on the right cover for your circumstances.

Critical illness cover is often added to a life insurance policy and provides protection if you’re diagnosed with a serious medical condition listed in the policy. This type of policy pays out a lump sum on diagnosis, which can be used to help with mortgage payments or support other financial responsibilities.

Mortgage Payment Protection Insurance is a policy that helps pay your monthly mortgage payments if you can’t work due to illness, injury or lose your job. This cover usually lasts for a short time (often up to 12 months) and only pays if you meet the terms and conditions of the policy.

We understand that claims are made at a difficult time, so we will do everything we can to support you and help you through the process with our Claims Team.

Here's what you'll need to complete your claims process:

- Find your policy details

- Contact your insurer directly or LifeSearch

- Pull your documentation together

- Submit your claim

- Insurer assesses your claim according to policy terms

- Receive your insurance payout

Our dedicated Claims Team are here to support you through your claims journey. You can visit our claims page, to see exactly what information you will need in order to make a claim.

LifeSearch is recommended by