Cutting costs, day to day

But what about those day-to-day changes in patterns and behaviours? What about the watch-out-for-the-pennies stuff?

This is coping with the cost-of-living crisis day-to-day

The changing work day

Looking at the data for the UK as a whole, we learn that many are re-approaching the work day (again) to make savings.

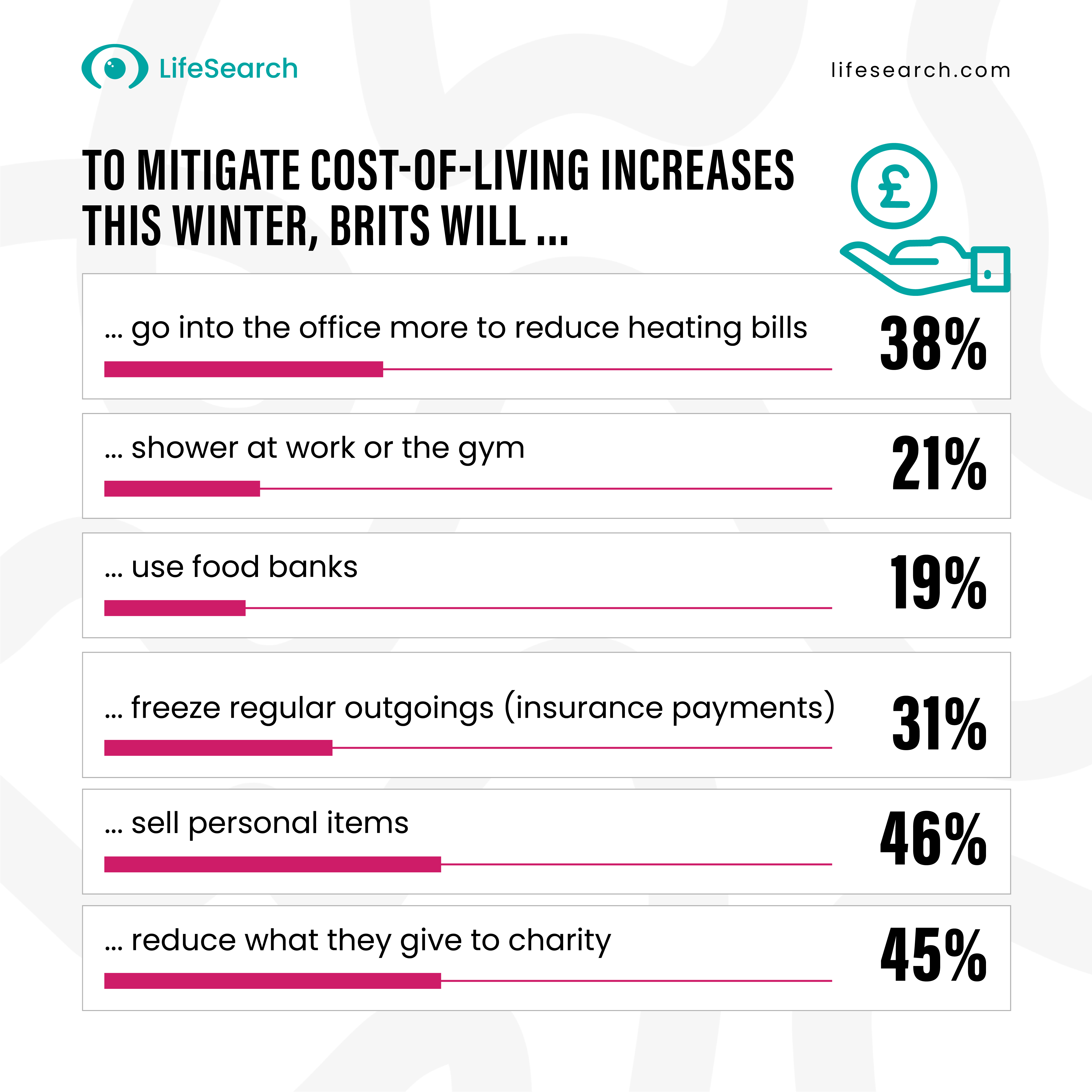

For example, 38% of Brits say they’re likely (9% say very likely) to head into the office more often than they currently do to save on their at-home energy bills. Likewise, nearly a third (32%) of Brits say they’re likely (7% very likely) to work more from shared spaces (coffee shops etc) for the same reason.

One in five (19%) Brits say they’re likely to car-pool with friends to save on the commute and, interestingly, just over one in five (21%) say they plan to shower at the gym or at work rather than at home to save a few quid there.

Changes at home

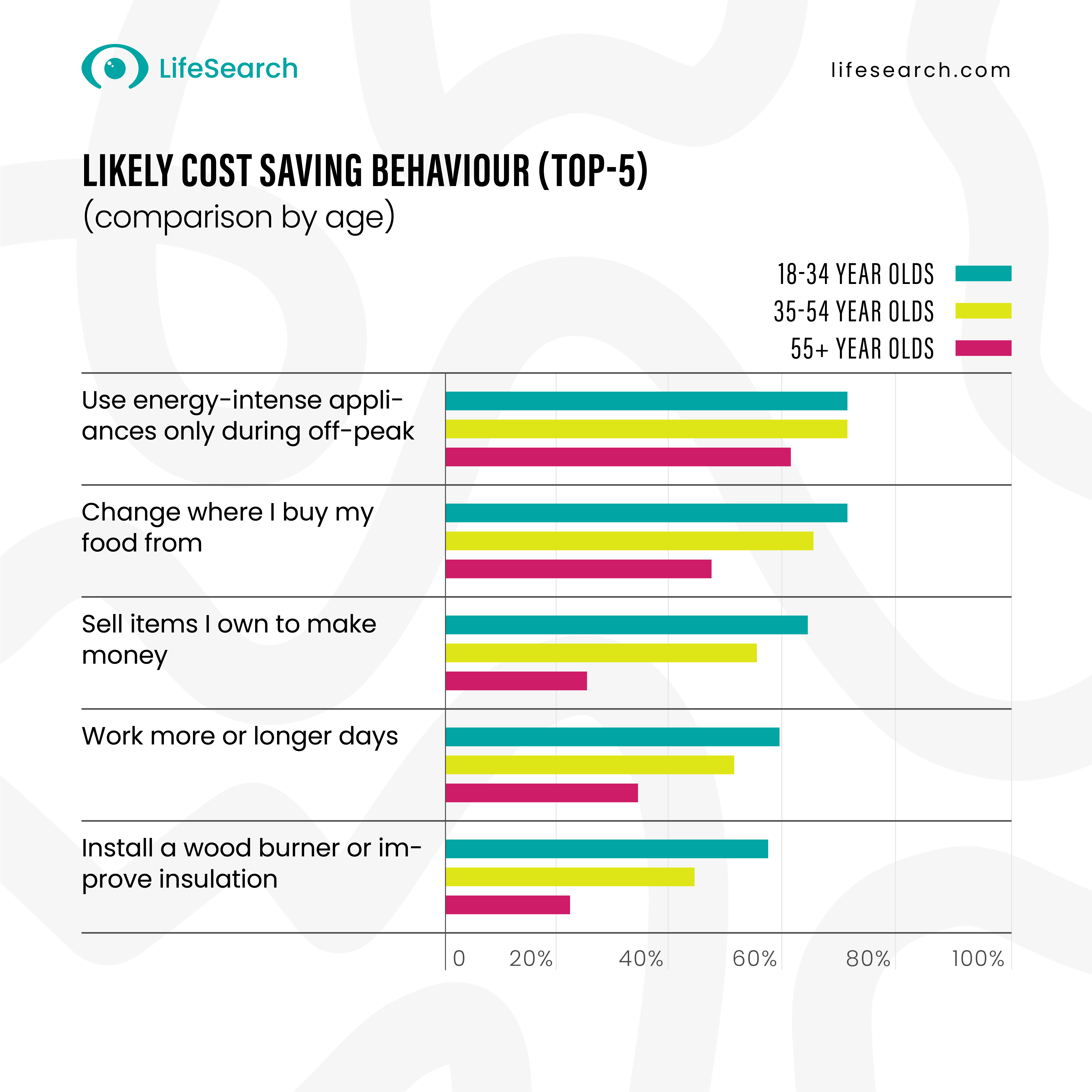

At home, we now know that 39% of Brits are likely (9% very likely) to improve the efficiency and / or cost of their in-home heating system by buying in new systems or by beefing up their insulation. Interestingly, nearly a third (30%) of Brits say they’re likely to install solar panels.

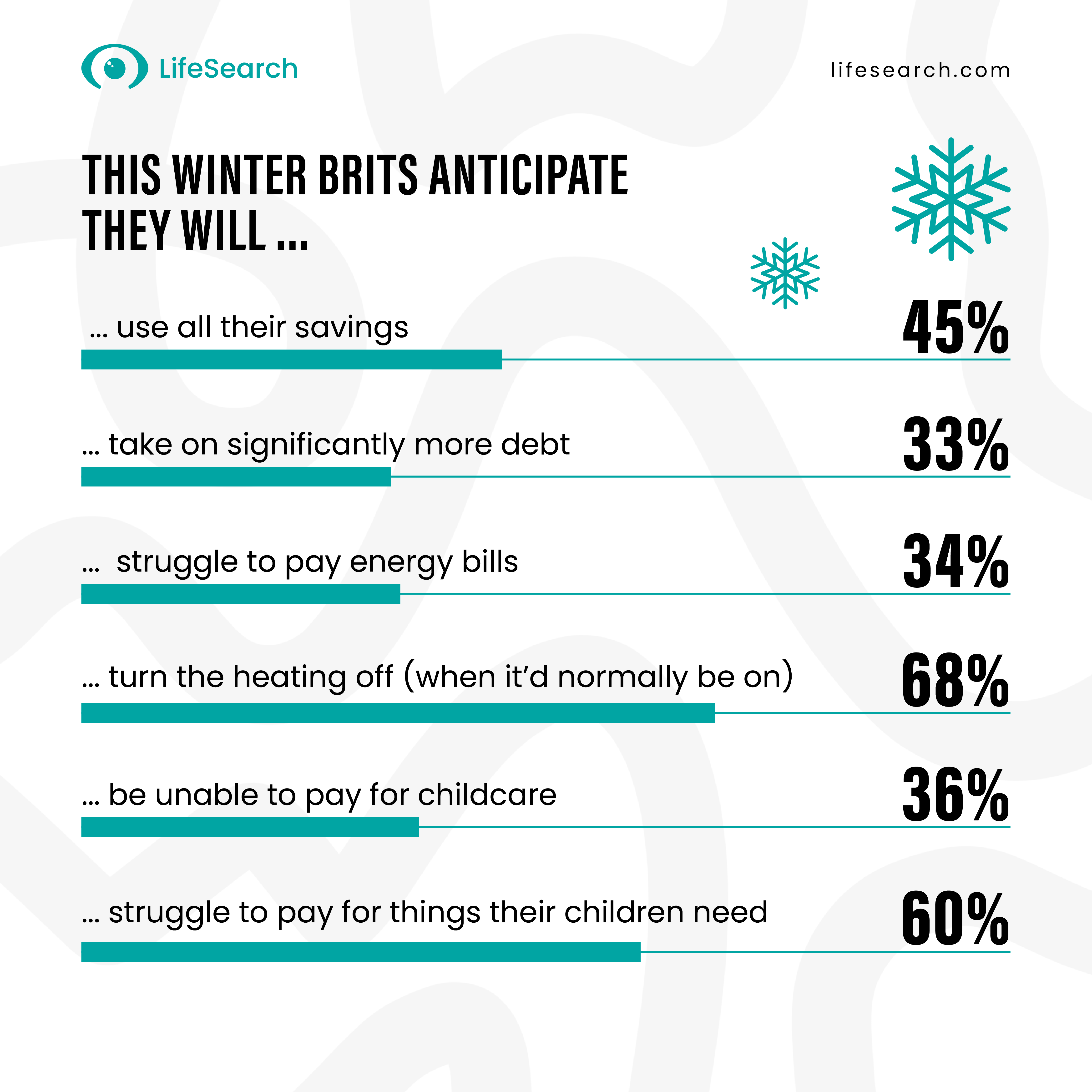

Well over a third of Brits (37%) say they’ll install smart meters and over two thirds (67%) say they’ll scale back using high-energy appliances during peak hours.

Perhaps this fits more accurately in our Dreams delayed blog but we now know that 13% of Brits say that moving in with parents or friends to ease costs is a likely scenario.

Time to make a little extra

To create more financial headroom, we learned that nearly half (46%) of Brits say it’s likely they will sell personal items (one in ten say this is extremely likely), and one in seven (13%) British households say it’s likely they’ll rent out a room, either as a long term or holiday let.

A hugely significant 40% say it is likely they will take on an extra job and over half (51%) of the workforce say they plan to work more or longer days to buy a financial cushion.

Tightening expenditure

The prior behaviours are designed to keep costs down or to buy some wiggle room. Now it’s the cuts.At the time of writing, inflation is into double digits and the country is wrestling with a weakened pound following major shifts in the UK budget / tax environment. Cost-of-living impacts everything but perhaps the most obvious places the supermarket till.

With that, it was inevitable, by choice or by default, that Brits would have to alter their grocery habits and, sure enough, the majority (60%) say they are likely (36% extremely or very likely) to swap their regular supermarkets for discounters, markets and other cost-effective options.

Other spend items set for the chop include charity giving, wherein 45% saying it’s likely they’ll cut back. Interestingly, some 15% say it’s likely they will freeze their mortgage payments and, of particular note for our industry, nearly a third (31%) say they are likely to freeze monthly outgoings such as insurance payments.

As much as the above measures point solidly at crisis, this last stat is particularly sobering: one in 20 Brits (19%) say they are likely to use food banks and/ or charity support in the coming months, with 8% saying this is very or extremely likely.

Further reading

To explore the ways in which different UK demographics, regions, households and families are coping with the vice-like squeeze on their incomes, you can read blogs stemming from the Health, Wealth & Happiness Hub, or you can read the report in full.LifeSearch have been protecting the life you love since 1998. We've protected over 1 million of families in our time. Read our views and opinions on the latest industry news, and what we have to say on all things Health, Wealth & Happiness. Our content is brought to you by LifeSearcher's and guest writers.See all articles by LifeSearch

Why Mortgage Protection Shouldn’t Be Overlooked

Find out about the latest HomeOwner Survey, conducted by HomeOwners Alliance in partnership with LifeSearch and others.

21 Sep 2025, by LifeSearch

4 min read

Debbie Kennedy Features on the IFA Talk Podcast

Listen to Debbie Kennedy discuss the growing protection gap among UK mortgage holders.

11 Sep 2025, by LifeSearch

6 min read

Females hit harder on mortgage payments

Female mortgage holders could be working harder to stay afloat as income shocks expose widening protection gap.

10 Jul 2025, by LifeSearch

6 min read