Life and Critical Illness Cover (or ‘CIC’ as the industry calls it) is a very common partnership as it pays out if you die (life insurance) and if you’re diagnosed with / suffer a life-changing illness (critical illness cover). The types and severity of conditions covered will vary by insurer, so it’s important to check in advance.

What is life insurance?

Life insurance is the one you probably know. If you die with active life insurance, your insurer will pay out an amount of money as agreed when you bought the policy.

What is critical illness cover?

Critical illness cover pays out if you’re diagnosed with a specified life-changing illness or condition. As standard, most policies cover heart attacks, strokes and some cancers, but others include disability, blindness, neurological conditions and more.

Why combine both?

Combining two-in-one can be cost-effective, and it basically means you and love ones are covered against the financial implications of the two things in life many of us fear most.

As an independent intermediary, LifeSearch are loyal to customers, not the insurer. It’s our job to help you figure out your protection needs and to match you up with policies – from across the life insurance market – that fit the bill.

You tell us your situation and we’ll bring you policy options that fit the bill. We search, we advise, you decide.

We’ve spent a generation helping UK individuals, businesses and families protect the life they love. We’re rated "Excellent" from 22,000 Trustpilot reviews written by customers just like you.

Life insurance options

The two most popular kinds of life insurance, are level-term life insurance and decreasing term life insurance.

There’s ‘whole of life cover’ too. Speak with an expert adviser for advice on what’s best for you.

Level term life insurance

Level term life insurance is when the pay-out amount (if/ when you die) doesn’t change. Take out £200,000 of level term cover over 20 years and your loved ones will receive exactly that amount whether you die on day five or day 5,000 of your policy’s life.

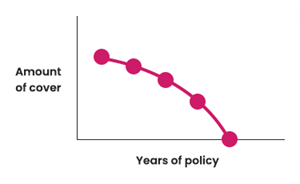

Decreasing term life insurance

In a decreasing term life insurance policy, the overall cover amount decreases over time to reflect the value of your mortgage. As mortgage is paid back the amount required to pay it off (if something happened to the mortgage holder) reduces.

What’s best: level term or decreasing cover?

Whether level-term or decreasing cover is best for you depends on your needs, mortgage type and budget as well as your health and circumstances.

Level term is generally more expensive but the specified payment amount means your loved ones know exactly what’s coming to them. Decreasing term is more affordable and excellent for covering a mortgage but it doesn’t provide a financial cushion; as level term often does.

We can help you work out how much cover you need

Deciding on your ideal cover level can be difficult. Get a feel for how much you need with our calculator, then speak with a LifeSearch expert and tell them about your situation. We can guide you on cover types and policy options that speak to your needs and budget.

How much does life and critical illness cover cost?

The average cost of a Life + Critical Illness policy, over the term of 25 years

| Starting Age | Cost to cover payout of £75,000 |

|---|---|

| 25 |

£15.38 |

| 30 |

£19.11 |

| 35 | £26.12 |

| 40 |

£37.49 |

| 45 | £55.63 |

| 50 |

£89.20 |

| 55 |

£159.85 |

*Pricing information obtained 29/05/2025. This data is based on a non-smoker with no medical history.

Critical illness cover can be a standalone product but more often than not it is bought alongside life insurance - to cover all bases and because it’s usually more affordable to bundle.

How much you pay for critical illness cover depends on where you’re at now (age, health, circumstances), and how much cover you want – i.e. how much you want your lump sum payout to be.

Life insurance cost and cover calculator

Our simple calculator can help you to work out what insurance you need and give you estimated costs for different types of life cover. You can then speak to an adviser or buy online.

The above table shows average costs and is a good guide. But your costs depend on you: what’s going on and the level of cover you want.

The main variables that define the cost of your combined life and critical illness policies are:

Your age

As a rule-of-thumb, the younger you buy the cheaper life insurance is. Buy young and you’re more likely to be fit and healthy.

Also, buy young and your life insurance premium (how much you pay each month) is locked in for the duration of the policy, unless you amend or add to it later down the line.

Some policies can be ‘index linked’ to keep in-line with inflation, so your monthly premium will increase annually. But generally, the most common policy is a level or decreasing term one, that remains the same monthly cost throughout it’s term.

Your health

If you have a chronic or significant health issue, it may increase your risk in the eyes of insurers and that’ll reflect in your premiums.

Note that having a health issue is not the barrier to cover it once was. Depending on what’s specified in your policy, If your condition is mild and your symptoms well-managed, you may not see any premium increases at all.

Even if you have a more serious condition, insurers today are much more accommodating. And there are specialist insurers whose whole business is covering people with health challenges.

Your lifestyle

Smoking, drinking, drugs, hobbies … no-one’s here to judge your lifestyle and choices but they can have a bearing on your life insurance / critical illness cover prospects.

Smoking (including vaping and cigars), for example, is still probably the most significant variable in determining your life insurance price.

Your cover level

How much cover you want to leave your loved ones and/ or to act as a safety net if you get critically ill is up to you.

The costs of a critical illness

If you’re diagnosed with a critical illness, or suffer a life-changing event, your day-to-day routine will probably change. Your running costs may change.

The knock-ons can put a strain on your household coffers and impact those you care about:

New equipment costs

With a new health situation, you may need to sink significant cash into buying clothes, items and equipment that make daily life more comfortable.

Home modifications

If mobility is suddenly an issue, your home may need to be adapted to improve access, move rooms or generally be reconfigured to match your new needs.

Impact on income

If you’re diagnosed with a life-changing illness, you’ll almost certainly miss periods of work and you may have to give up work altogether. That could mean the end of your income.

Medical costs

The NHS may cover all your medical needs but additional medicines, therapies and treatments – or private care if you go that way – will add significant cost.

Travel and transport

If your condition isn’t treatable locally, additional transport, parking and fuel costs will mount up.

Your kids’ future

Without help absorbing the extra costs of illness, your life plans – and your ability to support the people you love – could be badly damaged.

Frequently asked questions & tips about life and critical illness cover

If you’ve level term life insurance, you can link your sum insured (the lump-sum payable when you die) to inflation.

Basically, money loses its value over time. Ten years ago, £100 had about £20 more buying power more than does today. Index-linking means your life insurance lump sum keeps the same buying power over time - so your money doesn’t lose its value.

Your premiums will rise to reflect inflation too so it’s best to speak with a LifeSearch expert to determine if this is a way you’d want to go.

Although funerals can be expensive things, the financial implications of death go further and wider. If you’re no longer there to contribute to the household it’ll leave a huge financial gap, as well as an emotional one.

There’s also your debt, your mortgage(s), and the commitments you can no longer pay.

Life insurance pays out so those you leave behind can cover your costs and even invest in their own futures. Without a financial safety net, the burden of all of the above is on others.

You can keep down the costs associated with death by putting your life insurance policy into trust. We can help you with more information and how to go about this with your insurer.

Putting a policy in trust locks it out of a deceased person’s estate. This means a life insurance lump-sum will probably avoid inheritance tax. It should also avoid the probate process, meaning claims funds will be released more quickly.

Read more about putting your policy into Trust.

Easy guides to help you get started

A quick guide to critical illness insurance

Did you know that critical illness insurance can protect you against over 50 different illnesses?

By Katie Crook-Davies, Protection Writer

5 min read

What illnesses does CIC cover?

And is more always better when it comes to the number of conditions covered? Find out in this guide.

By Katie Crook-Davies, Protection Writer

4 min read

Critical Illness Cover vs Health Insurance

Battle of the policies - what are the differences?

By LifeSearch,

5 min readLifeSearch is recommended by