The release of pent-up demand

A snapshot of spending in 2021

Through much of 2020, many Britons were saving money and paying down debt. With fewer spending opportunities in the physical world, the money we did spend flowed online, cue major gains for many online stores, digital entertainment services and takeaway food providers.

But with measures being relaxed, slowly and steadily, through 2021, we want to break down what it looks like when pent-up demand is released after 12-months-plus of retail restraint.

Here goes:

Caffeinated and satiated

The first thing to note in the 2021 data is that Brits rediscovered coffee shops, and then some.

Our takeaway tea and coffee spend basically doubled on 2020, to an average of £13.70 per person per month.

The most caffeinated age group are the 18-34s. In 2020, they spent a monthly average of £13.50 on hot drinks, but in 2021 that almost doubled to £24 per head per month. Meanwhile, our cravings for takeaway food, which multiplied in deep lockdown, are definitely here to stay.

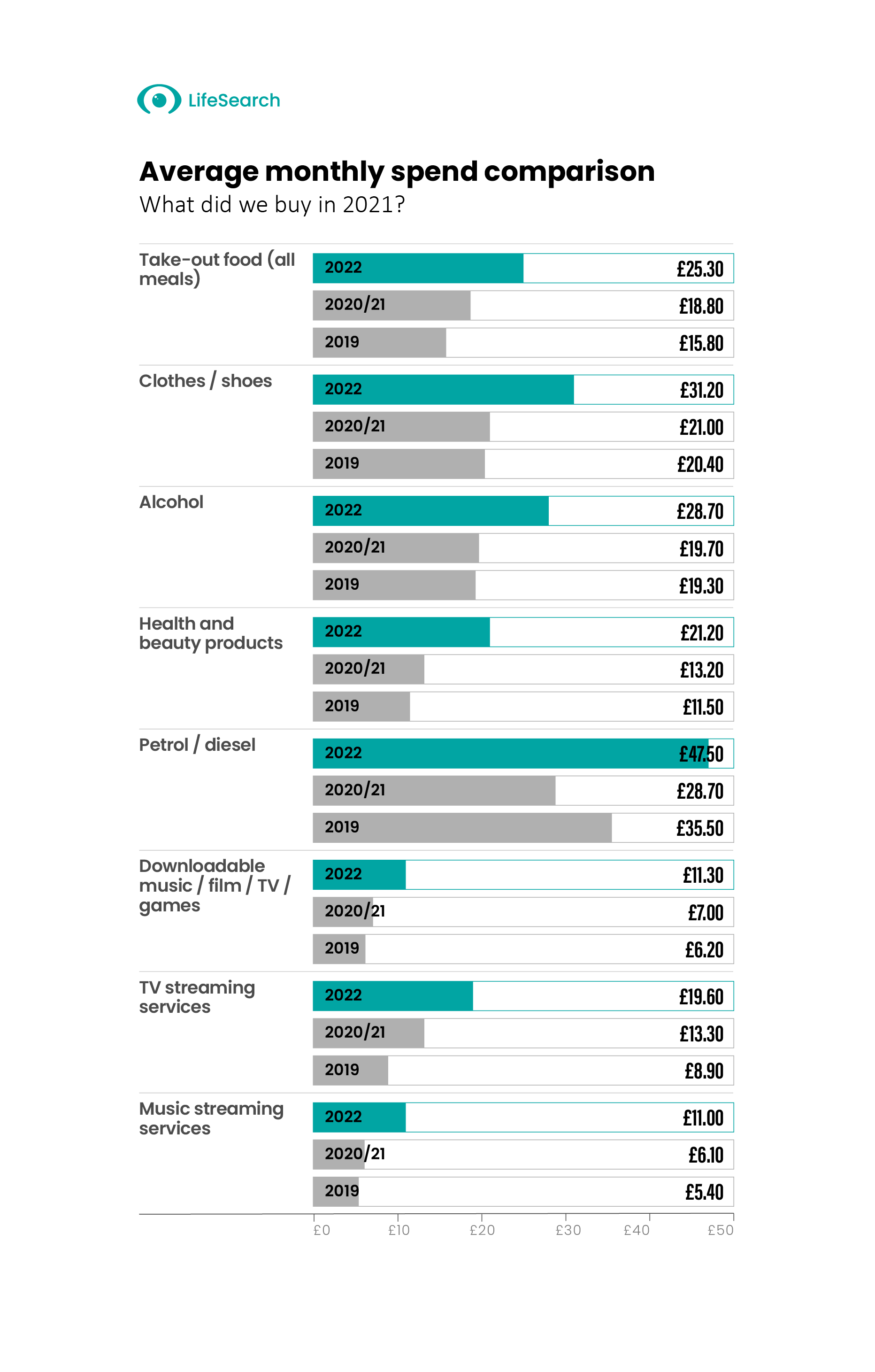

In 2020, the average monthly spend on takeaway food was £18.80 per head, up £3 on 2019, and this year it's up considerably more. A takeaway spend of £25.30 per head per month in 2021 shows delivery firms are still making good on gangbuster pandemic business.

Liquid Consumption

Takeaway food outfits have done well through 2020/ 2021 largely as a result of pubs, restaurants and venues being closed for long stretches. That same lockdown dynamic saw our monthly alcohol spend decrease in 2020... but in 2021 we made up for lost thirst.

The biggest alcohol spenders are men at an average £35.30 per person per month to women's £22.40; 18-34s spent £31.40 to 55-and-overs' £25.

Our petrol diesel spend was back with a vengeance too. After hitting a new average low of £28.70 per person per month during 2020, it shot back up - largely thanks to panic buying in the October fuel crisis - to an average of £47.50. For context, the 2019 (pre-pandemic) average was £35.50 per person per month.

With fuel costs rising as a result, now, of war, what we pay at the pump is only going to go one way.

Revitalising retail

High streets might have been closed in 2020, but online retail means we spent about the same as pre-pandemic on things like clothes and shoes, and health and beauty products.

In 2021, Brits now had a choice of virtual and physical destinations in which to shop... and we did.

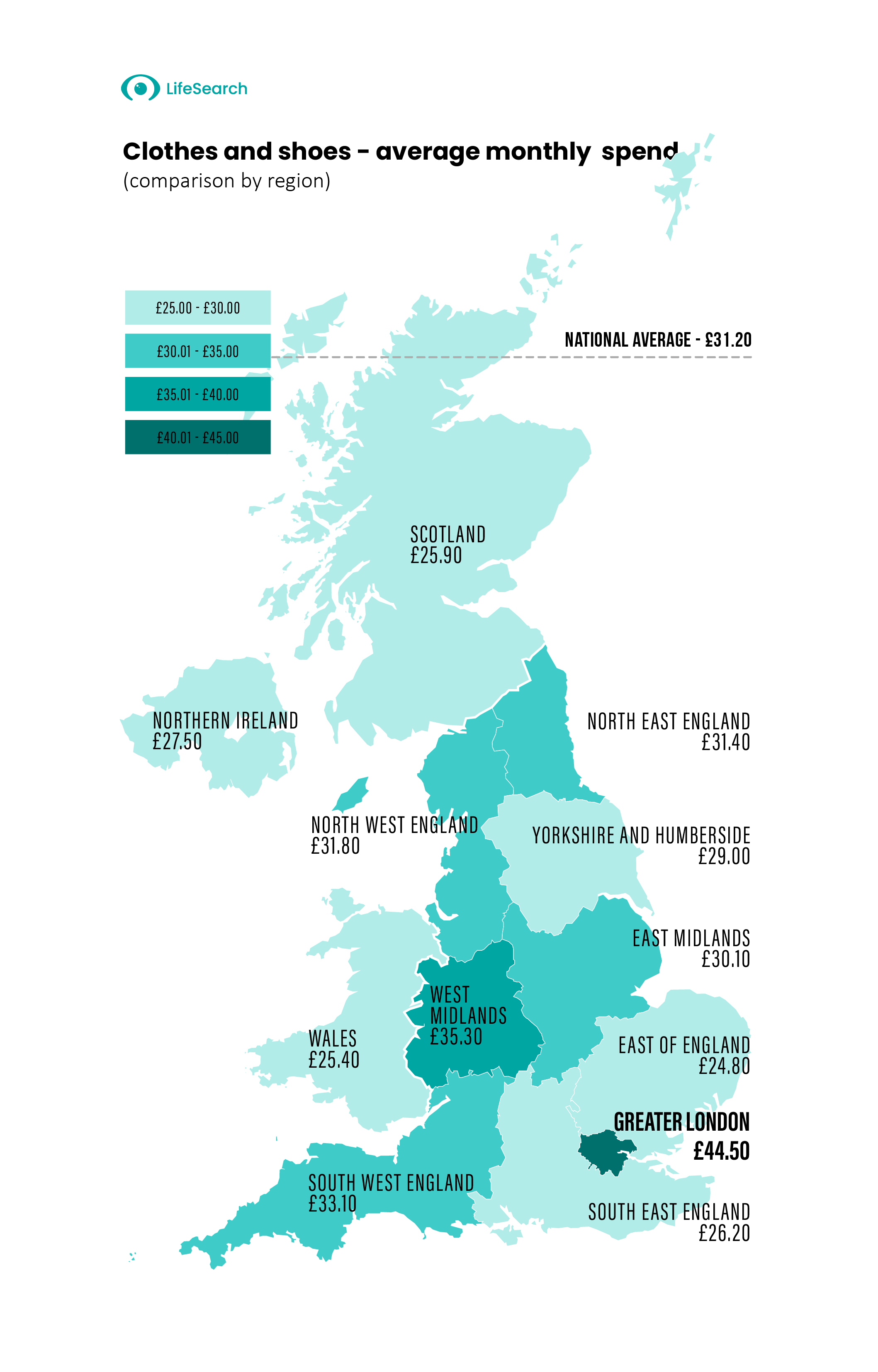

The average Briton spent £31.20 per month on clothes and shoes in 2021 - over £10 more than in 2020. Interestingly, in 2021 men spent £2.70 more per month than women.

Health and beauty spending also rebounded to hit a new high. It was up 50% on 2020 to an average spend of £21.20 per person per month, and £31.80 among 18-34s.

In 2020, the UK's spend on TV streaming services was up from £8.90 in 2019 to £13.30. By 2021, it increased further still to an average spend of £19.60 per person per month.

Our wider media spend (gaming, films, music) went from £7 per head per month in 2020 to £11.30 per head per month in 2021. Under 35s spent an average of £21.60 each month on media last year. Although we should say that this trend was steadily gathering pace even before the pandemic.

We also spent more in both online and in-store retail categories than we did in 2020. Online grocery deliveries rose on 2020, already a record-breaking year, to reach an average spend of £40.70 per head, a near-25% increase.

Regrets?

The release of pent-up demand in consumers was always coming, but it's sobering to put the UK's elevated spend levels in 2021 side-by-side with the clear and present danger of rising living costs.

Health, Wealth & Happiness data reveals how the nation is very wary of what's coming; and whether a lack of savings - and an uncertain geopolitical environment - will expose average people to the blunt end of the squeeze.

A ‘Searcher since 2015, John is a Protection expert having worked in our customer facing teams and best practice teams, and now is immersed in Protection Content and Marketing.See all articles by John Rogers

Why Mortgage Protection Shouldn’t Be Overlooked

Find out about the latest HomeOwner Survey, conducted by HomeOwners Alliance in partnership with LifeSearch and others.

21 Sep 2025, by LifeSearch

4 min read

Debbie Kennedy Features on the IFA Talk Podcast

Listen to Debbie Kennedy discuss the growing protection gap among UK mortgage holders.

11 Sep 2025, by LifeSearch

6 min read

Females hit harder on mortgage payments

Female mortgage holders could be working harder to stay afloat as income shocks expose widening protection gap.

10 Jul 2025, by LifeSearch

6 min read